Tokio Marine is a leading global insurance company with a proven track record of providing innovative risk management solutions to its clients. With a presence in over 40 countries and regions, Tokio Marine offers a wide range of insurance products and services to meet the needs of businesses and individuals around the world.

Tokio Marine is a respected and trusted name in the insurance industry, with a long history of providing innovative risk management solutions to its clients. Their commitment to providing customized solutions, financial stability, and excellent customer service makes them a valuable partner for businesses and individuals looking to manage their risks effectively.

To help you gain a deeper understanding of Tokio Marine and its offerings, we've done the analysis, dug into the information, and put together this comprehensive guide. We'll provide you with key takeaways, explore their innovative solutions, and highlight their commitment to customer satisfaction. By the end of this guide, you'll have a clear understanding of why Tokio Marine is a trusted leader in the global insurance market.

| Feature | Tokio Marine | Other Insurance Providers |

|---|---|---|

| Global Presence | 40+ countries and regions | Limited reach |

| Range of Products | Comprehensive offerings for businesses and individuals | Narrower product lines |

| Innovation | Focus on developing cutting-edge solutions | Limited innovation |

| Financial Stability | Strong financial foundation | Varies among providers |

| Customer Service | Dedicated to providing exceptional support | May vary in quality |

FAQ

Tokio Marine's commitment to exceptional risk management solutions is evident in every aspect of our operations. Our dedication to providing tailored solutions is matched by our commitment to delivering transparent and comprehensive information to our valued clients. In this section, we have compiled a list of frequently asked questions to clarify common concerns and misconceptions.

Question 1: What sets Tokio Marine apart from other insurance providers?

Tokio Marine distinguishes itself through our unwavering commitment to innovation and customization. Our team of experts collaborates closely with clients to meticulously assess their unique risk profiles and tailor solutions that effectively mitigate potential threats. This personalized approach ensures that each client receives coverage that aligns precisely with their specific requirements.

GrECo Advent Calendar 2022 - GrECo risk and insurance management - Source greco.services

Question 2: How does Tokio Marine handle claims?

Tokio Marine prioritizes prompt and efficient claims handling. Our dedicated claims team is highly experienced in navigating complex insurance matters. We work diligently to ensure that claims are processed swiftly and fairly, minimizing disruptions for our clients during challenging times.

Question 3: What are the benefits of partnering with Tokio Marine for risk management?

By partnering with Tokio Marine, clients gain access to a comprehensive suite of risk management services designed to safeguard their operations. Our team of experts provides invaluable insights, proactive risk assessments, and tailored solutions that empower clients to make informed decisions and proactively manage potential threats.

Question 4: How does Tokio Marine stay abreast of emerging risks?

Tokio Marine recognizes the dynamic nature of the risk landscape. Our team of experts continuously monitors industry trends, technological advancements, and global events to identify and anticipate emerging risks. This foresight enables us to proactively develop innovative solutions that effectively address the evolving needs of our clients.

Question 5: What is Tokio Marine's commitment to sustainability?

Tokio Marine is deeply committed to sustainability and responsible business practices. We actively incorporate environmental, social, and governance (ESG) considerations into our operations and investment decisions. By aligning our actions with sustainable principles, we aim to create long-term value for our stakeholders while contributing to a more sustainable future.

Question 6: How can I learn more about Tokio Marine's risk management solutions?

We encourage you to explore our website for detailed information on our comprehensive range of risk management solutions. Additionally, our team of experts is readily available to provide personalized consultations and tailored recommendations based on your specific requirements. Do not hesitate to contact us for further assistance.

Summary of key takeaways or final thought

Thank you for choosing Tokio Marine as your trusted insurance partner. Our unwavering commitment to innovation, customization, and exceptional service ensures that you receive the highest level of protection against potential risks. We are dedicated to providing tailored solutions that empower you to manage risks confidently and achieve sustained growth.

Transition to the next article section

To further enhance your understanding of risk management and its impact on your organization, we invite you to explore our comprehensive library of resources. Our expert insights, case studies, and thought leadership articles are designed to provide valuable guidance and support as you navigate the complexities of risk management. Stay connected with Tokio Marine for the latest industry updates, innovative solutions, and exclusive access to our risk management webinars and events.

Tips by Tokio Marine: A Global Insurance Leader Providing Innovative Risk Management Solutions

In today’s globalized and increasingly complex business environment, managing risk effectively is critical for organizations of all sizes. Tokio Marine, a world-renowned insurance leader, has decades of experience in providing innovative risk management solutions that help businesses navigate the challenges of the modern world. Drawing from their expertise, here are several crucial tips to aid businesses in effectively managing risk:

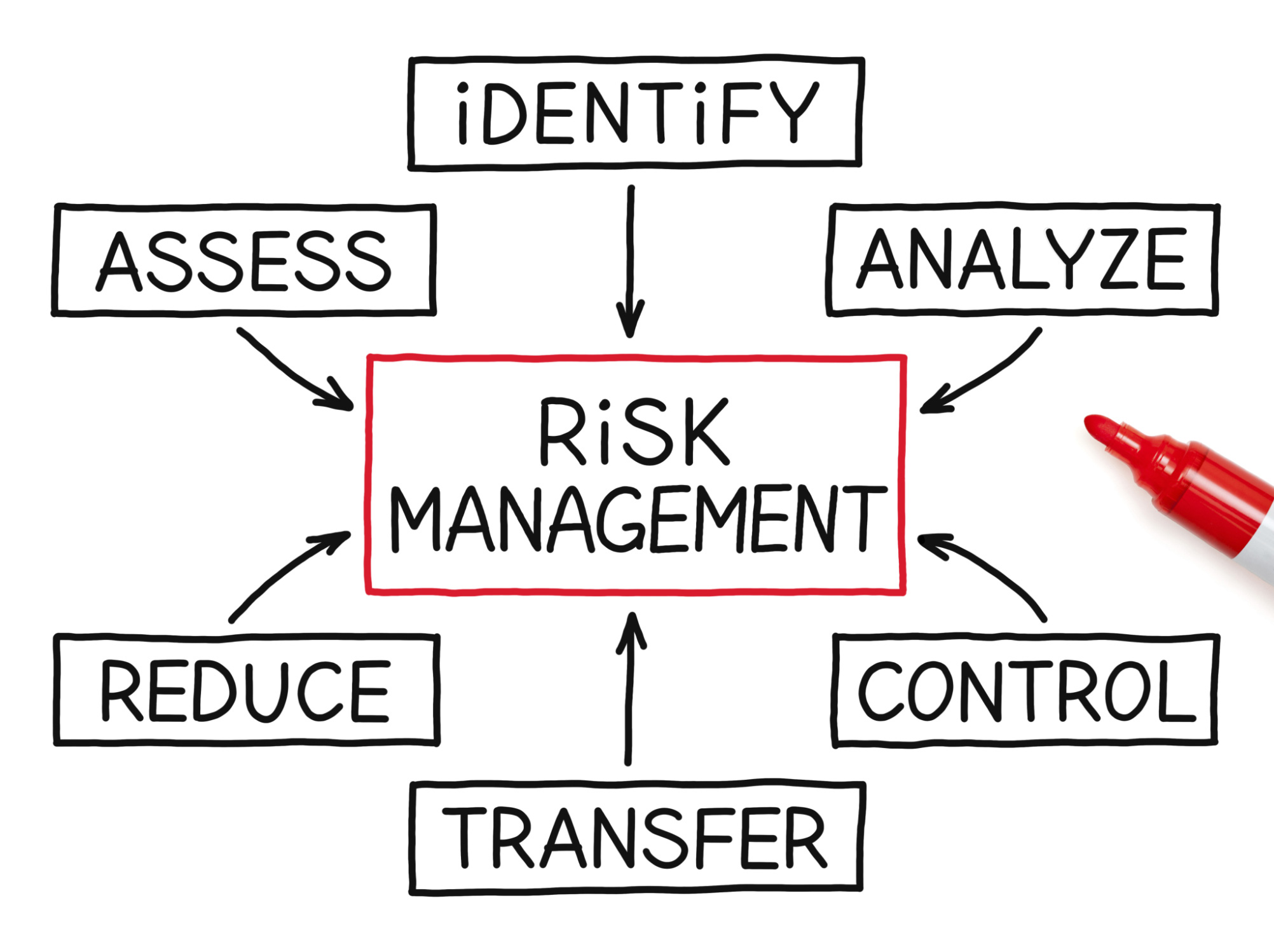

Tip 1: Conduct a Thorough Risk Assessment

Identifying and analyzing potential risks is the foundation of effective risk management. Conducting a comprehensive risk assessment enables organizations to gain a clear understanding of the threats they face, their potential impact, and their likelihood of occurrence. This information provides a solid basis for developing tailored risk mitigation strategies.

Tip 2: Implement Robust Risk Mitigation Measures

Once risks have been identified, businesses should proactively implement robust mitigation measures to reduce their potential impact. This involves developing and executing plans to address each risk effectively. Mitigation strategies may include implementing security measures, establishing business continuity plans, and acquiring adequate insurance coverage.

Tip 3: Monitor and Review Risks Regularly

Organizations must continuously monitor and review their risks to ensure that mitigation measures remain effective. As the business landscape evolves, new risks may emerge, and existing risks may change in nature. Regular monitoring and review enable timely adjustments to risk management strategies, ensuring ongoing protection.

Tip 4: Seek Professional Risk Management Advice

Managing risks effectively can be a complex task. Tokio Marine strongly advises seeking professional advice from experienced risk management consultants. These experts can provide invaluable insights, assist in conducting risk assessments, and develop customized risk management solutions tailored to the specific needs of each organization.

Tip 5: Utilize Technology for Risk Management

Technology plays a vital role in modern risk management. Employing specialized software and tools can streamline risk assessment and monitoring processes, enhance data analysis, and improve overall risk visibility. Utilizing technology effectively can significantly enhance a business’s ability to identify, mitigate, and respond to risks.

By following these tips, businesses can significantly improve their risk management practices and enhance their resilience against potential threats. Tokio Marine remains committed to providing innovative risk management solutions that help organizations navigate the complexities of the modern business world.

Tokio Marine: A Global Insurance Leader Providing Innovative Risk Management Solutions

Tokio Marine stands out as a global insurance behemoth, renowned for its comprehensive suite of risk management solutions that seamlessly align with the ever-evolving needs of modern businesses and individuals. The company's unwavering commitment to innovation, customer-centricity, and global reach are the cornerstones of its enduring legacy.

- Global Presence: Tokio Marine's global footprint spans over 40 countries, catering to diverse insurance needs across continents.

- Innovation-Driven: The company is constantly pushing the boundaries of insurance through cutting-edge technologies and data-driven solutions.

- Specialized Products: Tokio Marine provides tailored insurance solutions for niche industries, addressing specific risks and complexities.

- Financial Strength: With a robust financial foundation, Tokio Marine ensures prompt claims settlement and long-term stability.

- Customer-Centric: The company places customer satisfaction at the heart of its operations, offering personalized services and responsive support.

- Sustainability Focus: Tokio Marine integrates environmental, social, and governance considerations into its business practices, promoting a sustainable future.

Tokio Marine's collaborative approach with clients has resulted in innovative solutions that address emerging risks, such as cyberattacks and climate change. Furthermore, its global network enables the sharing of best practices and expertise, ensuring that clients benefit from cutting-edge risk management strategies. The company's commitment to sustainability extends beyond risk management, with initiatives focused on reducing its environmental footprint and supporting social impact programs.

Tokio Marine: A Global Insurance Leader Providing Innovative Risk Management Solutions

Tokio Marine, a globally renowned insurance provider, has established itself as a leader in risk management through a relentless pursuit of innovation. The company's expertise encompasses a wide range of insurance products, spanning property and casualty coverage to specialized solutions tailored to unique industry needs. At the core of Tokio Marine's success lies its unwavering commitment to understanding the evolving risk landscape and adapting its offerings accordingly.

Management Insurance – Haibae Insurance Class - Source haibae.com

The significance of Tokio Marine's risk management expertise cannot be overstated. In an increasingly dynamic business environment marked by heightened geopolitical uncertainties, cyber threats, and natural catastrophes, organizations face unprecedented risks. Tokio Marine's ability to anticipate these risks and develop proactive solutions empowers clients to navigate the challenges, safeguard their operations, and achieve long-term success.

Real-life examples of Tokio Marine's innovative risk management solutions abound. The company's partnership with a global technology firm to provide tailored cyber insurance policies underscores its deep understanding of the unique risks associated with digital transformation. Additionally, Tokio Marine's development of a comprehensive risk management program for a major healthcare provider demonstrates its ability to mitigate the complex challenges faced by the industry.

The practical significance of Tokio Marine's risk management solutions extends beyond individual organizations to the broader economy. By safeguarding businesses, the company contributes to economic stability and resilience. Tokio Marine's innovative approach to risk management fosters a conducive environment for investment and innovation, ultimately driving sustainable growth.

Conclusion

Tokio Marine's leadership in risk management serves as a beacon of innovation within the insurance industry. The company's deep understanding of the evolving risk landscape and unwavering commitment to tailored solutions empowers organizations to navigate challenges, safeguard their operations, and achieve long-term success.

As the business environment continues to evolve, Tokio Marine's unwavering commitment to innovation and client-centric approach positions it as an indispensable partner for organizations seeking to mitigate risks and seize opportunities. The company's continued pursuit of innovative risk management solutions promises to shape the future of the insurance landscape, ensuring that organizations have the tools and expertise they need to thrive in an increasingly complex and uncertain world.