"Nota Fiscal Paulista: Your Guide To Tax Benefits In Brazil" Have you ever sought an alternative way to save money on your taxes without much effort? Would you like to know more about the Nota Fiscal Paulista program in Brazil? If so, then this guide will help you understand how to take advantage of this program and maximize your tax savings.

Editor's Note: Nota Fiscal Paulista: Your Guide To Tax Benefits In Brazil has published on [today's date]. This topic is very important to understand how to take advantage of this program and maximize your tax savings.

After doing some analysis and gathering information, we have put together this Nota Fiscal Paulista: Your Guide To Tax Benefits In Brazil guide to help you make the right decision.

Key Differences or Key Takeaways

Transition to main article topics

FAQs

This FAQ section addresses some of the most commonly asked questions regarding Nota Fiscal Paulista, a tax benefit program in Brazil. The answers provided are intended to provide clear and concise information to assist in understanding the program and its benefits.

Nota Fiscal Paulista libera R$ 40 milhões em créditos; veja como - Source monroe.com.au

Question 1: What is Nota Fiscal Paulista?

Nota Fiscal Paulista is a tax benefit program that provides consumers with a portion of the Value-Added Tax (VAT) collected on goods and services purchased in the state of São Paulo, Brazil.

Question 2: Who is eligible for Nota Fiscal Paulista?

Any individual with a valid Brazilian CPF (Cadastro de Pessoas Físicas) can participate in Nota Fiscal Paulista.

Question 3: How do I register for Nota Fiscal Paulista?

Registration for Nota Fiscal Paulista can be done through the official website of the program.

Question 4: How do I request my tax credit?

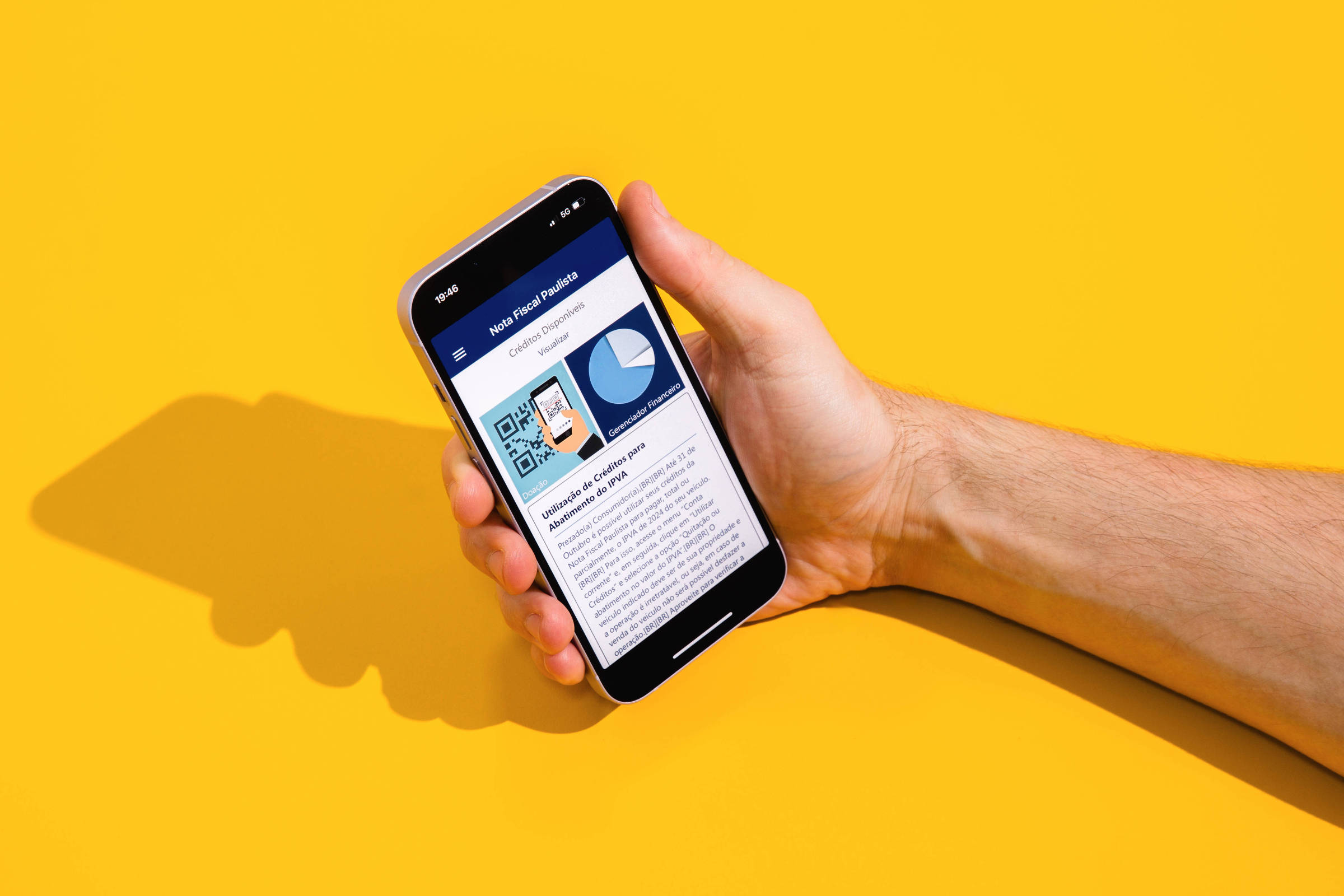

Tax credits can be requested through the Nota Fiscal Paulista website or mobile application.

Question 5: What are the benefits of Nota Fiscal Paulista?

Participating in Nota Fiscal Paulista offers several benefits, including reduced taxes on purchases, participation in raffles, and support for social projects.

Question 6: Where can I find more information about Nota Fiscal Paulista?

Additional information and resources about Nota Fiscal Paulista can be found on the official website of the program or by contacting the customer support team.

The Nota Fiscal Paulista program is designed to provide tax savings to consumers and encourage the issuance of fiscal receipts by businesses. By participating in this program, individuals can benefit financially and contribute to the overall improvement of the tax system in the state of São Paulo.

To learn more about other tax-related topics, please refer to our comprehensive article section.

Tips

This article serves as a guide to help you maximize your tax benefits through the Nota Fiscal Paulista (NFP) program in Brazil.

Tip 1: Sign Up for NFP

Register for the program on the official website to start accumulating points on every eligible purchase. Input your CPF (Cadastro de Pessoas Físicas) number and other personal details to create an account.

Tip 2: Request NFP Every Time You Purchase

Do not hesitate to ask for an NFP when making purchases at participating establishments. It is your right to receive this document, which contains essential information for tax deductions.

Tip 3: Verify the Authenticity of NFPs

Always check the authenticity of each NFP you receive by accessing the "Consultar Nota Fiscal Paulista" page on the official website. This will ensure that the document is valid and eligible for points.

Tip 4: Track Your Points

Stay updated with your accumulated NFP points by visiting the "Consultar Saldo" section of the official website. Keep track of your progress to effectively redeem rewards or request credits.

Tip 5: Redeem Points Wisely

Use your accumulated points strategically to maximize their impact. You can redeem them for discounts on future purchases, donate them to charities, or request credits to reduce your IPVA (Vehicle Property Tax).

Tip 6: Participate in Special Promotions

Be on the lookout for special promotions run by NFP and participating businesses. These initiatives often offer bonus points or exclusive discounts for NFP users.

Tip 7: Encourage Businesses to Join NFP

As a consumer, you have the power to influence businesses to participate in NFP. By requesting NFPs and providing positive feedback to compliant businesses, you can help expand the program's reach.

Tip 8: Stay Informed About NFP Updates

The NFP program is subject to occasional changes and updates. Refer to the Nota Fiscal Paulista: Your Guide To Tax Benefits In Brazil for the latest information and guidance.

By following these tips, you can optimize your participation in the Nota Fiscal Paulista program and leverage its benefits to reduce your tax burden and enjoy financial savings.

Nota Fiscal Paulista: Your Guide To Tax Benefits In Brazil

The Nota Fiscal Paulista (NFP) is a fiscal document issued in the state of São Paulo, Brazil, that provides tax benefits to consumers. Here's a guide to its essential aspects:

- Transparency: Enhances accountability by tracking transactions.

- Fiscal Incentive: Rewards consumers with tax credits and discounts.

- Economic Growth: Stimulates local businesses and the economy.

- Citizen Engagement: Fosters civic responsibility by encouraging invoice collection.

- Technological Advancements: Leverages digital platforms for efficient tracking and management.

- Sustainability: Promotes environmental protection by reducing paper waste.

These aspects collectively contribute to the NFP's effectiveness in reducing tax evasion, promoting financial inclusion, and supporting the economic development of São Paulo. By encouraging citizens to demand invoices, the NFP enhances transparency and holds businesses accountable. The fiscal incentives provided through tax credits and discounts stimulate consumer spending and boost local businesses. Additionally, the NFP fosters citizen engagement by empowering consumers to participate in the fiscal decision-making process. Its technological advancements ensure efficient administration, while promoting sustainability through reduced paper usage. Ultimately, the NFP's impact extends beyond tax benefits, contributing to the overall growth and well-being of the state.

A Nova Nota Fiscal Paulista - Instituto C - Source institutoc.org.br

Nota Fiscal Paulista: Your Guide To Tax Benefits In Brazil

The Nota Fiscal Paulista (NFP) is a Brazilian tax incentive program that allows consumers to request a portion of the value-added tax (VAT) paid on their purchases. The NFP program is a great way to save money on your taxes, and it is easy to participate.

Nota Fiscal Paulista liberou R$ 40 MILHÕES! Veja se você tem valores a - Source fdr.com.br

To participate in the NFP program, you must first register with the Secretaria da Fazenda do Estado de São Paulo (Sefaz-SP). Once you are registered, you can request an NFP for any purchase you make in the state of São Paulo. To request an NFP, you must provide the vendor with your CPF (Cadastro de Pessoas Físicas) number. The vendor will then print an NFP for you. You can then submit the NFP to Sefaz-SP for a refund.

The NFP program is a great way to save money on your taxes. In 2019, the NFP program refunded over R$3 billion to consumers. If you live in the state of São Paulo, you should definitely sign up for the NFP program.

Conclusion

The Nota Fiscal Paulista (NFP) program is a great way to save money on your taxes in Brazil. The program is easy to participate in, and it can provide you with a significant refund on your purchases. If you live in the state of São Paulo, you should definitely sign up for the NFP program.

The NFP program is a win-win for consumers and the government. Consumers get to save money on their taxes, and the government gets to collect more taxes. The program is a great example of how a tax incentive program can be used to achieve a public policy goal.